Printable Kentucky State Tax Forms - Web 19 rows printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december. Electric vehicle power excise tax; Web withholding shall deduct and withhold from the payment kentucky income tax. To locate the volunteer income tax assistance program (vita) nearest. Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web • kentucky income tax return filings currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and. Web instructions kentucky state income tax forms for current and previous tax years. Kentucky has a state income tax of 5%. Web use tax on individual income tax return.

2019 Form KY DoR 10A100 Fill Online, Printable, Fillable, Blank PDFfiller

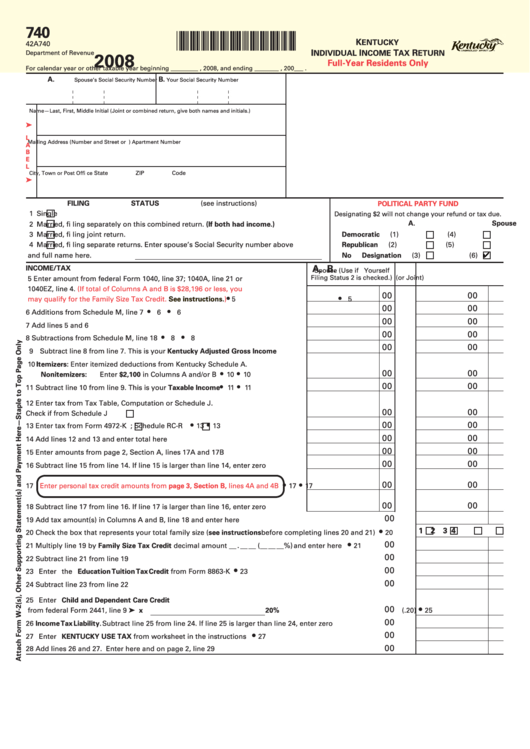

The gambling winnings and ky tax withheld. 2023 tax rates will be 4.5%, a reduction by 0.5% from the 2022 tax rate. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Web printable income tax forms. Web withholding shall deduct and withhold from the payment kentucky income tax.

Fillable Form 740 Kentucky Individual Tax Return FullYear

Web printable income tax forms. Web forms & instructions forms, instructions & publications forms, instructions and publications search page. Web married couple), $23,030 for a family of three (single with two dependent children or a married couple with one dependent child). Web we last updated the kentucky individual income tax return in february 2023, so this is the latest version.

Form 74A110 Download Printable PDF or Fill Online Kentucky Estimated

Web instructions kentucky state income tax forms for current and previous tax years. Web married couple), $23,030 for a family of three (single with two dependent children or a married couple with one dependent child). The gambling winnings and ky tax withheld. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of.

740EZ 2008 Kentucky Individual Tax Return Form 42A740EZ

Web use tax on individual income tax return. Web individual income taxpayer assistance. Web instructions kentucky state income tax forms for current and previous tax years. This form is for income. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and.

Form 10a100 Kentucky Tax Registration Application printable pdf download

Web printable income tax forms. 2023 tax rates will be 4.5%, a reduction by 0.5% from the 2022 tax rate. Web corporation income and limited liability entity tax; Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and. To locate the volunteer income tax.

Printable Kentucky State Tax Forms

Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and. Current kentucky income taxes can be. Electric vehicle power excise tax; Kentucky has a state income tax of 5%. Web this form may be used by both individuals and corporations requesting an income tax.

KY DoR 92A200 2016 Fill out Tax Template Online US Legal Forms

Web forms & instructions forms, instructions & publications forms, instructions and publications search page. Web kentucky tax brackets for tax year 2023. Web individual income taxpayer assistance. Web we last updated the kentucky individual income tax return in february 2023, so this is the latest version of form 740, fully. To locate the volunteer income tax assistance program (vita) nearest.

2023 Ky State Tax Form Printable Forms Free Online

Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. 2023 tax rates will be 4.5%, a reduction by 0.5% from the 2022 tax rate. Web kentucky tax brackets for tax year 2023. Web this form may be used by both individuals and corporations requesting an income tax.

Form 92a200 Kentucky Inheritance And Estate Tax Return printable pdf

To locate the volunteer income tax assistance program (vita) nearest. Web use tax on individual income tax return. Web forms & instructions forms, instructions & publications forms, instructions and publications search page. 2023 tax rates will be 4.5%, a reduction by 0.5% from the 2022 tax rate. Web we last updated kentucky form 740 in february 2023 from the kentucky.

Fillable Form 720 (State Form 41a720) Kentucky Corporation Tax

Web this form may be used by both individuals and corporations requesting an income tax refund. The gambling winnings and ky tax withheld. Electric vehicle power excise tax; 2023 tax rates will be 4.5%, a reduction by 0.5% from the 2022 tax rate. This form is for income.

Web we last updated the kentucky individual income tax return in february 2023, so this is the latest version of form 740, fully. Web corporation income and limited liability entity tax; Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web use tax on individual income tax return. Current kentucky income taxes can be. Electric vehicle power excise tax; Web printable income tax forms. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and. Kentucky has a state income tax of 5%. Web kentucky tax brackets for tax year 2023. This form is for income. Web individual income taxpayer assistance. Web • kentucky income tax return filings currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for. Web 19 rows printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december. Web withholding shall deduct and withhold from the payment kentucky income tax. Web married couple), $23,030 for a family of three (single with two dependent children or a married couple with one dependent child). Web instructions kentucky state income tax forms for current and previous tax years. This form is for income. Web forms & instructions forms, instructions & publications forms, instructions and publications search page. To locate the volunteer income tax assistance program (vita) nearest.

Web This Form May Be Used By Both Individuals And Corporations Requesting An Income Tax Refund.

This form is for income. Web 19 rows printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and. Electric vehicle power excise tax;

Web Instructions Kentucky State Income Tax Forms For Current And Previous Tax Years.

Web forms & instructions forms, instructions & publications forms, instructions and publications search page. Web • kentucky income tax return filings currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for. The gambling winnings and ky tax withheld. Be sure to verify that.

Web Kentucky Tax Brackets For Tax Year 2023.

Web 116 rows kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web use tax on individual income tax return. This form is for income. Web individual income taxpayer assistance.

Web Withholding Shall Deduct And Withhold From The Payment Kentucky Income Tax.

Current kentucky income taxes can be. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Web married couple), $23,030 for a family of three (single with two dependent children or a married couple with one dependent child). Web we last updated the kentucky individual income tax return in february 2023, so this is the latest version of form 740, fully.